AvaTrade Review 2026 – Fees, Safety & Is It Worth It?

With 18+ years in business, 6 global licenses, and 400,000+ traders worldwide, we break down AvaTrade's fees, platforms, and safety to see if it's the right broker for you.

Start Trading with AvaTrade →Complete AvaTrade Overview MONTH YEAR

AvaTrade is a Dublin-based multi-asset broker founded in 2006, offering forex, CFDs, and cryptocurrency trading through multiple regulated entities worldwide. Licensed across 6 jurisdictions including ASIC, CySEC, and FCA, the broker serves over 400,000 clients with a comprehensive platform selection including MetaTrader 4/5, proprietary web and mobile applications, and social trading solutions.

Complete AvaTrade Company Overview

Essential company information, trading conditions, and account details

Deposits & Accounts

- Minimum Deposit: $100

- Base Currencies: EUR, USD, GBP, AUD

- Islamic Account: Available

Trading Conditions

- Max Leverage: 1:400 (1:30 EU)

- Instruments: 1,250+

- Execution: Market Maker

Company Info

- Founded: 2006

- Headquarters: Dublin, Ireland

- Regulations: 6 Tier-1 Licenses

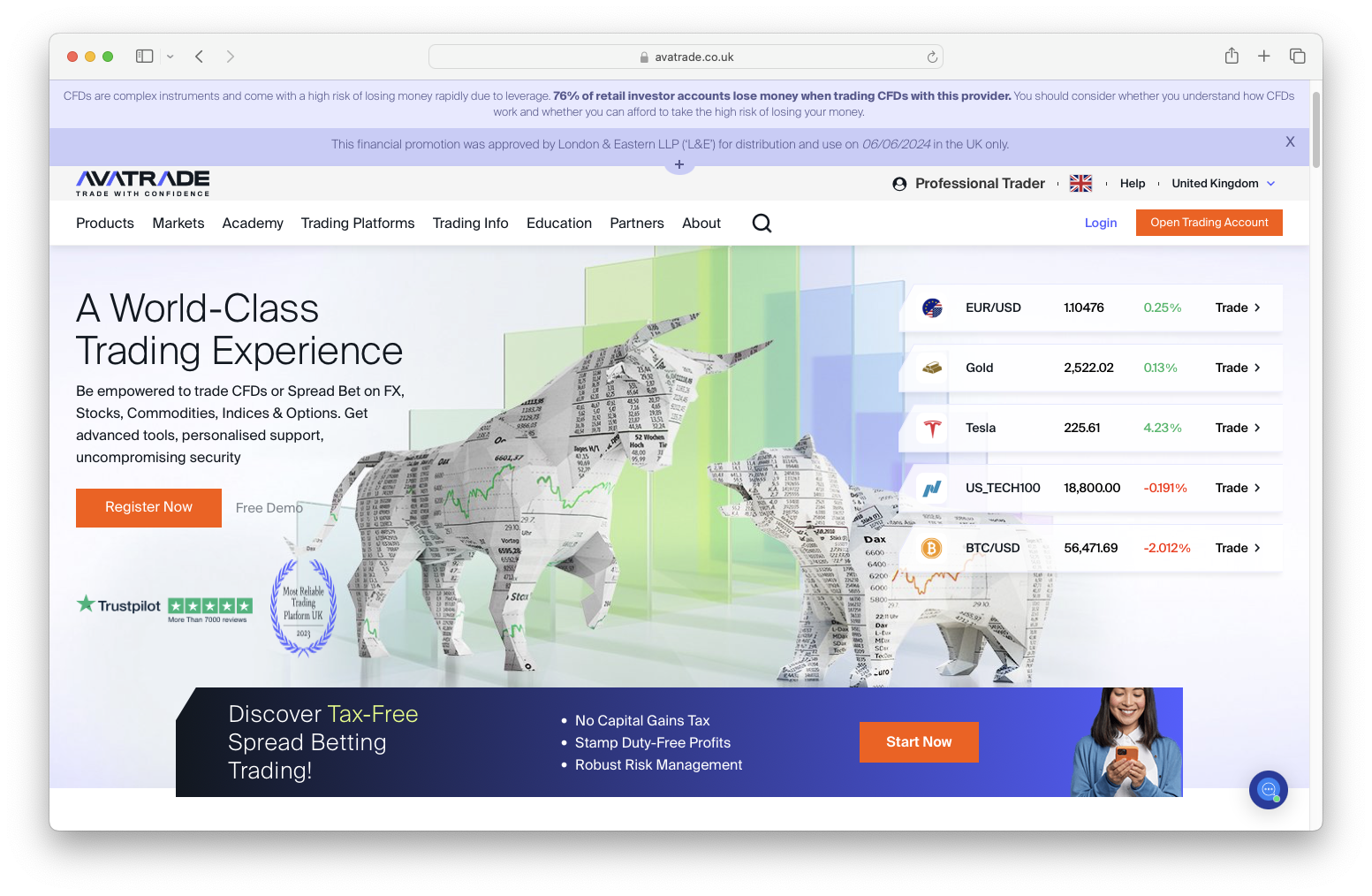

AvaTrade's professional website interface showcasing their comprehensive trading platform

Why Choose AvaTrade?

Four key reasons traders choose AvaTrade over competitors

AvaTrade Key Features

Multi-Regulated

Licensed by 6 tier-1 authorities including ASIC, CySEC, and FCA for maximum safety

AvaProtect

Unique trade insurance feature protects positions from loss during specified time windows

1,250+ Markets

Wide asset coverage including forex, stocks, indices, commodities, and cryptocurrencies

Education

Free demo account with comprehensive educational resources for new traders

AvaTrade Fees & Spreads Compared

How AvaTrade's costs stack up against IC Markets, IG, and the Industry Average

| Fee Type | AvaTrade | IC Markets | IG Group | Industry Average |

|---|---|---|---|---|

| EUR/USD Spread | 0.9 pips | 0.1 pips | 0.6 pips | 1.2 pips |

| GBP/USD Spread | 1.5 pips | 0.3 pips | 0.9 pips | 1.8 pips |

| Commission | No | $3.50/lot | No | Varies |

| Deposit Fees | Free | Free | Free | Free |

| Withdrawal Fees | First free/month | Free | $15 | $25 |

| Inactivity Fee | $50/quarter | $10/month | $18/month | $15/month |

Cost Analysis:

AvaTrade's spreads are competitive for a market maker model, sitting between premium ECN brokers like IC Markets and traditional retail brokers. While not the tightest spreads available, their zero commission structure and reasonable inactivity fees make them cost-effective for moderate-frequency traders.

Safety & Regulation

Six-way regulation providing maximum trader protection

Safety & Regulation

Licensed across multiple tier-1 jurisdictions with client fund protection

Ireland

Australia

Cyprus

United Kingdom

South Africa

Japan

Client Fund Protection

Multiple layers of security for your trading capital

Segregated Accounts

Client funds held separately from company funds

Negative Balance Protection

Account cannot go below zero

Compensation Schemes

Up to AU$500,000 protection per client

AvaTrade's regulatory licenses and client protection overview

Trading Platforms

Professional trading platforms designed for every type of trader

MetaTrader 4

Industry-standard platform with advanced charting and automated trading capabilities

- Expert Advisors

- Advanced Charting

- Mobile Trading

MetaTrader 5

Next-generation platform with additional markets and improved features

- Multi-Asset Trading

- Economic Calendar

- Enhanced Analysis

AvaTradeGO

AvaTrade's proprietary mobile-first platform with intuitive design

- Mobile Optimized

- AvaProtect

- Social Trading

WebTrader

Browser-based trading platform with no downloads required

- No Download

- Cross-Platform

- Real-time Data

DupliTrade

Social copy trading platform to follow successful traders

- Copy Trading

- Strategy Selection

- Risk Management

ZuluTrade

Popular social trading platform with large trader network

- Social Trading

- Signal Providers

- Performance Analytics

Account Types & Opening Process

Simple account setup with multiple options for different trading styles

| Account Type | Minimum Deposit | Max Leverage | Key Features |

|---|---|---|---|

| 📈 Standard | $100 | 1:400 (1:30 EU) | Full platform access, AvaProtect |

| ☪️ Islamic | $100 | 1:400 (1:30 EU) | Sharia-compliant, swap-free trading |

| 💼 Professional | $1,000 | 1:400 | Higher leverage, reduced protections |

| 🎮 Demo | Free | 1:400 | $100,000 virtual funds, full features |

Process Steps

Follow these simple steps

1. Register Online

Complete the 5-minute registration form with basic personal information

2. Verify Identity

Upload government ID and proof of address documents for verification

3. Fund & Trade

Make your first deposit and start trading immediately

⚠️ ESMA Leverage Restrictions: EU retail clients are limited to maximum 1:30 leverage on major pairs, 1:20 on minor pairs, and 1:10 on exotic pairs under ESMA regulations. Professional clients can access higher leverage up to 1:400.

Deposit & Withdrawal Methods

Fast, secure ways to fund your trading account

| Method | Deposit Time | Withdrawal Time | Deposit Fee | Withdrawal Fee | Min/Max |

|---|---|---|---|---|---|

Credit/Debit Card Credit/Debit Card | Instant | 3-5 business days | Free | Free | $100 / $40,000 |

Bank Transfer Bank Transfer | 1-3 business days | 3-5 business days | Free | First free/month | $100 / No limit |

Skrill Skrill | Instant | 24 hours | Free | Free | $100 / $10,000 |

Neteller Neteller | Instant | 24 hours | Free | Free | $100 / $10,000 |

PayPal PayPal | Instant | 24-48 hours | Free | Free | $100 / $5,000 |

Additional Notes:

- Credit/Debit Card: Visa and Mastercard accepted

- PayPal: Not available in all regions

Withdrawal & Payment Information

Complete overview of payment processing, fees, and conditions

Key Details

Quick Analysis

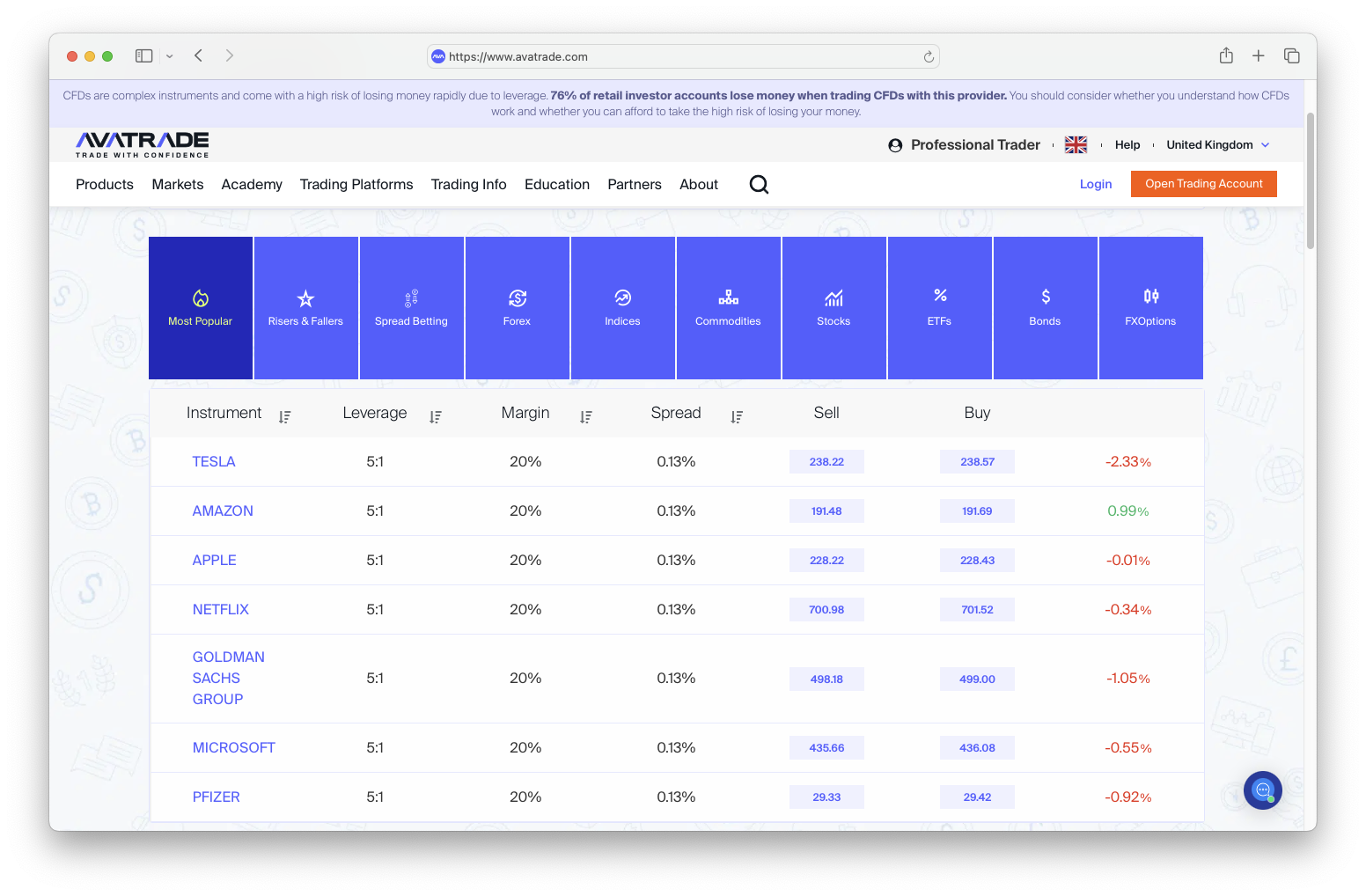

Trading Instruments & Asset Classes

Access to global markets with competitve conditions and 1,250+ instruments across all major asset classes

Major, minor, and exotic currency pairs with tight spreads

Trade major global stock indices as CFDs

Precious metals, energy, and agricultural commodities

Individual stocks from major global exchanges

Exchange-traded funds covering various sectors and regions

24/7 trading on major cryptocurrencies

Government and corporate bonds from major economies

Vanilla options trading on various underlying assets

AvaTrade's comprehensive financial instruments across 8 asset classes

AvaTrade Pros & Cons

Balanced analysis of AvaTrade's strengths and weaknesses

Pros

- Pro: Licensed by 6 top-tier regulators including FCA, ASIC, and CySEC

- Pro: Comprehensive educational resources and trading tools

- Pro: AvaProtect feature provides unique trade insurance

- Pro: Multiple professional trading platforms including MT4/MT5

- Pro: No commission on forex and CFD trading

- Pro: Competitive spreads on major currency pairs

- Pro: Social trading through DupliTrade and ZuluTrade

- Pro: 24/7 multilingual customer support

- Pro: Islamic accounts available for Sharia-compliant trading

- Pro: Wide range of 1,250+ trading instruments

Cons

- Con: Higher spreads compared to ECN brokers

- Con: Limited cryptocurrency selection versus dedicated crypto exchanges

- Con: AvaProtect feature comes with additional costs

- Con: Withdrawal fees after first free withdrawal per month

- Con: No MetaTrader Supreme Edition available

- Con: Research tools could be more comprehensive

Frequently Asked Questions

Expert answers to common AvaTrade questions

Yes, AvaTrade is regulated by 6 top-tier authorities including the FCA (UK), ASIC (Australia), CySEC (Cyprus), Central Bank of Ireland, FSCA (South Africa), and JFSA (Japan). Client funds are held in segregated accounts with compensation schemes up to €20,000 (EU), £85,000 (UK), or AU$1M (Australia) depending on jurisdiction.

The minimum deposit at AvaTrade is $100 (or equivalent in other base currencies). This applies to all account types and makes AvaTrade accessible to beginner traders. However, higher deposits may be required for certain premium features or account types.

Yes, AvaTrade offers free demo accounts with $100,000 virtual funds. Demo accounts are available for all platforms including MetaTrader 4, MetaTrader 5, and AvaTradeGO. Demo accounts remain active for 30 days and can be renewed if needed.

AvaProtect is AvaTrade's unique trade insurance feature that protects your trading positions from loss for a specified time period. You pay a premium (typically 1-3% of position size) to insure a trade for up to 1 hour. If the trade goes against you during the protection period, AvaTrade covers the loss.

Yes, AvaTrade fully supports Expert Advisors and automated trading through MetaTrader 4 and MetaTrader 5 platforms. There are no restrictions on EA usage, and you can run multiple EAs simultaneously. The platforms also support algorithmic trading and custom indicators.

AvaTrade offers one free withdrawal per calendar month. Additional withdrawals incur fees depending on the method: bank transfers typically cost $25, while e-wallet withdrawals (Skrill, Neteller) are usually free. Credit card withdrawals are processed back to the original card at no charge.

No, AvaTrade does not accept clients from the United States due to regulatory restrictions. US residents should look for CFTC-regulated brokers like OANDA or Forex.com that are licensed to serve American clients.

Withdrawal processing times vary by method: e-wallets (Skrill, Neteller) take 24 hours, credit/debit cards take 3-5 business days, and bank transfers take 3-5 business days. All withdrawals are processed within 1 business day of approval, with additional time for bank processing.

Yes! The AvaTrade partner code is 128979. Use this code during registration to receive a welcome bonus of up to $10,000 depending on your deposit amount. Visit our AvaTrade Partner Code page for full bonus tiers and step-by-step instructions.

Final Verdict

AvaTrade stands out as a well-regulated, feature-rich broker that prioritizes trader education and safety over ultra-competitive pricing. With six global licenses, unique risk management tools like AvaProtect, and comprehensive platform options, it's particularly suited for intermediate traders who value regulatory security and platform diversity.

✓ Best For

- Traders prioritizing regulatory safety and compliance

- Beginners seeking educational resources and demo accounts

- Intermediate traders wanting platform diversity (MT4/5, mobile, web)

- Social traders interested in copy trading features

- Risk-averse traders who value the AvaProtect insurance feature

- Traders requiring multilingual customer support

✗ Not Ideal For

- Professional scalpers needing ultra-tight spreads

- High-frequency traders requiring institutional-grade execution

- US residents (not accepted)

- Traders seeking commission-free stock trading

- Cryptocurrency specialists wanting extensive digital asset selection

- Cost-conscious traders prioritizing the lowest fees above all else

Risk Disclaimer: Trading forex, CFDs, and crypto is high risk. 72–89% of retail investors lose money. Consider whether you can afford this risk.

matched with AvaTrade

2 minutes ago